Exploring the realm of Self-Employed Health Insurance Options, this introduction delves into the intricacies of healthcare decisions for freelancers and entrepreneurs, providing insights and guidance in a formal yet engaging manner.

This discussion sheds light on the challenges and strategies related to accessing healthcare, managing costs, choosing providers, selecting insurance plans, understanding policies, maintaining records, and prioritizing screenings for self-employed individuals.

Healthcare Access

Easy access to healthcare services is crucial for self-employed individuals to maintain their health and well-being while managing their businesses. Unlike traditional employees who may have employer-sponsored health insurance plans and access to on-site clinics, self-employed individuals often face challenges in obtaining affordable and convenient healthcare services.

Importance of Healthcare Access for Self-Employed

- Timely access to healthcare services can prevent minor health issues from escalating into more serious conditions, allowing self-employed individuals to stay productive and focused on their work.

- Regular check-ups and preventive care are essential for early detection of health problems, which can ultimately reduce healthcare costs in the long run.

- Access to mental health services is also critical for self-employed individuals who may experience high levels of stress and anxiety due to the demands of running their own businesses.

Strategies for Improving Healthcare Access

- Consider joining a professional association or organization that offers group health insurance plans for self-employed individuals.

- Explore healthcare marketplaces and online platforms to compare different health insurance options and find the most suitable coverage at affordable rates.

- Utilize telemedicine services for virtual consultations with healthcare providers, which can save time and eliminate the need for in-person visits.

Challenges Faced by Self-Employed Individuals

- Lack of employer-sponsored health insurance can result in higher out-of-pocket costs for self-employed individuals, making it challenging to afford necessary healthcare services.

- Limited access to healthcare facilities and specialists in certain regions may require self-employed individuals to travel long distances for medical care.

- Inconsistent income streams and fluctuating business revenues can make it difficult for self-employed individuals to budget for healthcare expenses and maintain continuous coverage.

Healthcare Costs

When it comes to healthcare costs, self-employed individuals may face unique challenges compared to those with employer-sponsored health insurance. Understanding the typical expenses involved and finding ways to manage and budget for these costs effectively is crucial for financial stability and well-being.

Typical Healthcare Costs for Self-Employed Individuals

Self-employed individuals often have to bear the full cost of their health insurance premiums, which can be significantly higher than group rates offered through employers. In addition to premiums, out-of-pocket expenses such as deductibles, copayments, and coinsurance can add up quickly. Prescription medications, routine check-ups, and unexpected medical emergencies can further increase healthcare costs for self-employed individuals.

Comparison with Employer-Sponsored Health Insurance

Compared to those with employer-sponsored health insurance, self-employed individuals typically have higher healthcare costs due to the lack of employer contributions and group discounts. While employer-sponsored plans often cover a portion of premiums and offer lower out-of-pocket expenses, self-employed individuals are responsible for the full cost of their coverage and medical expenses.

Tips for Managing Healthcare Expenses

- Research and compare health insurance plans to find the most cost-effective option that meets your healthcare needs.

- Consider opening a Health Savings Account (HSA) or Flexible Spending Account (FSA) to save money tax-free for medical expenses.

- Create a separate budget for healthcare expenses and prioritize saving for future medical needs.

- Take advantage of preventive care services to avoid costly medical treatments down the line.

- Explore alternative healthcare options such as telemedicine or community health clinics for more affordable care.

Healthcare Providers

When you are self-employed, it is crucial to have access to reliable healthcare providers to ensure your well-being. Building a strong relationship with healthcare providers can lead to better continuity of care and more personalized treatment options. Here are some tips on how to choose the right healthcare provider as a self-employed individual.

Types of Healthcare Providers for Self-Employed Individuals

- Primary Care Physicians (PCP): These healthcare providers are usually the first point of contact for general healthcare needs and can help coordinate care with specialists.

- Specialists: These healthcare providers have expertise in specific areas of medicine and can provide focused care for particular health conditions.

- Urgent Care Centers: These facilities offer immediate medical attention for non-life-threatening illnesses or injuries, often with extended hours for convenience.

- Telemedicine Providers: Virtual healthcare services can provide consultations, prescriptions, and follow-up care remotely, making it easier for self-employed individuals to access healthcare.

Importance of Building a Relationship with Healthcare Providers

Establishing a rapport with your healthcare providers can lead to better communication, trust, and understanding of your unique health needs. This relationship can result in more personalized care and timely interventions when necessary.

Tips for Choosing the Right Healthcare Provider

- Research providers in your area and check their credentials, experience, and patient reviews.

- Consider your specific healthcare needs and find a provider who specializes in treating those conditions.

- Verify that the provider accepts your health insurance plan to avoid unexpected out-of-pocket costs.

- Schedule a consultation or visit to assess the provider’s communication style, approach to care, and compatibility with your preferences.

Health Insurance

Health insurance is a crucial consideration for self-employed individuals looking to protect themselves and their families from unexpected medical expenses. There are various health insurance options available for self-employed individuals, each with its own set of benefits and drawbacks.

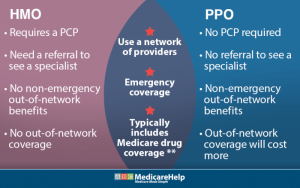

Individual Health Insurance vs Group Health Insurance

Individual health insurance plans are purchased directly by an individual from an insurance provider, while group health insurance plans are typically offered by employers to their employees. Here are some key differences between the two options:

- Individual Health Insurance:

- Provides coverage for the individual and their dependents.

- Offers more flexibility in choosing coverage options and benefits.

- Premiums are based on the individual’s age, health status, and coverage needs.

- May have higher out-of-pocket costs compared to group plans.

- Group Health Insurance:

- Coverage is typically more affordable due to group rates negotiated by the employer.

- Offers a wider range of coverage options and benefits.

- May have limited flexibility in choosing specific coverage options.

- Premiums are shared between the employer and the employee.

Key Factors for Selecting a Health Insurance Plan

When selecting a health insurance plan as a self-employed individual, it is essential to consider the following key factors:

- Cost: Evaluate monthly premiums, deductibles, copayments, and out-of-pocket maximums to determine affordability.

- Coverage: Assess the extent of coverage provided, including doctor visits, prescription drugs, hospitalization, and preventive care.

- Network: Ensure that the plan’s network includes your preferred healthcare providers to avoid out-of-network costs.

- Flexibility: Consider the flexibility to adjust coverage options and benefits as your needs change over time.

- Additional Benefits: Look for extra benefits such as telemedicine, wellness programs, and mental health services that can enhance your overall healthcare experience.

Health Policies

When it comes to healthcare coverage for self-employed individuals, there are key policies that should be carefully considered to ensure adequate protection and access to necessary medical services. Not having health insurance can have serious implications for self-employed individuals, including financial burden in case of unexpected medical expenses. Additionally, government healthcare policies can play a significant role in shaping the options available to self-employed individuals.

Key Health Policies for Self-Employed Individuals

- Individual Health Insurance Plans: Self-employed individuals can opt for individual health insurance plans to secure coverage for themselves and their families. These plans offer flexibility in terms of coverage options and premiums.

- Health Savings Accounts (HSAs): HSAs allow self-employed individuals to save money tax-free for medical expenses. Contributions to HSAs are tax-deductible, and funds can be used to pay for qualified medical expenses.

- Affordable Care Act (ACA): The ACA, also known as Obamacare, provides options for self-employed individuals to purchase health insurance through the Health Insurance Marketplace. Depending on income level, individuals may qualify for subsidies to help lower premium costs.

Implications of Not Having Health Insurance

- Financial Risk: Without health insurance, self-employed individuals may face significant financial risk in the event of a medical emergency or illness. Medical expenses can quickly add up and lead to financial hardship.

- Limited Access to Care: Lack of health insurance may result in limited access to healthcare services, preventive care, and essential treatments, impacting overall health and well-being.

Government Healthcare Policies for Self-Employed Individuals

- Medicaid Expansion: Some states have expanded Medicaid eligibility under the ACA, providing low-income self-employed individuals with access to free or low-cost health coverage. Eligibility criteria vary by state.

- Tax Credits and Subsidies: The government offers tax credits and subsidies to help offset the cost of health insurance premiums for self-employed individuals purchasing coverage through the Health Insurance Marketplace.

Health Records

Maintaining accurate health records is crucial for self-employed individuals to track their medical history, treatments, and appointments effectively. It not only helps in managing your healthcare but also ensures that you have access to important information when needed.

Organizing Health Records

- Create a dedicated folder or digital file for all your health records, including test results, prescriptions, and doctor’s notes.

- Label each document clearly with the date and type of record for easy reference.

- Consider using color-coded tabs or folders to separate different categories of health records.

- Regularly update your records and remove any outdated or irrelevant documents to maintain clarity.

Storing Health Records

- Choose a secure and easily accessible storage method, whether it’s a locked filing cabinet or encrypted cloud storage.

- Backup your electronic health records regularly to prevent data loss in case of technical issues.

- Keep a physical copy of important records in a safe place as a backup to digital storage.

- Consider using password protection or encryption for digital health records to ensure privacy and security.

Benefits of Electronic Health Records

Electronic health records have revolutionized the way self-employed individuals manage their healthcare by providing easy access to medical information anytime, anywhere. They offer benefits such as:

- Instant access to health records for appointments or emergencies.

- Ability to share records securely with healthcare providers for better coordination of care.

- Integration with health apps or devices for tracking and monitoring health metrics.

- Automatic reminders for appointments, medication refills, and preventive screenings.

Health Screening

Regular health screenings are essential for self-employed individuals to monitor their health status, detect any potential issues early on, and prevent serious health conditions. By staying proactive with health screenings, self-employed individuals can maintain their well-being and continue to thrive in their business.

Common Health Screenings

- Annual physical exams: to assess overall health and address any concerns.

- Blood pressure checks: to monitor heart health and detect hypertension.

- Cholesterol screenings: to evaluate heart disease risk.

- Blood glucose tests: to screen for diabetes.

- Colon cancer screenings: for individuals above a certain age or with risk factors.

- Regular skin checks: to detect skin cancer early.

Tips for Scheduling and Prioritizing Health Screenings

- Set reminders: Use calendar alerts or apps to schedule screenings in advance.

- Combine appointments: Opt for multiple screenings on the same day to save time.

- Make it a priority: Treat health screenings as non-negotiable appointments.

- Consider telehealth options: Explore virtual health screenings for convenience.

- Consult with healthcare providers: Discuss your specific health needs and create a screening plan.

In conclusion, Self-Employed Health Insurance Options offer a comprehensive guide for navigating the complex landscape of healthcare choices as an independent worker, empowering individuals to make informed decisions and prioritize their well-being effectively.

Expert Answers

What are the key challenges self-employed individuals face in accessing healthcare services?

Self-employed individuals often struggle with limited access to affordable healthcare options and may find it challenging to navigate the complexities of the healthcare system without employer support.

How can self-employed individuals effectively manage and budget for healthcare expenses?

Self-employed individuals can manage healthcare costs by setting aside a dedicated budget, exploring high-deductible health plans, utilizing health savings accounts, and negotiating prices with healthcare providers.

What are the key factors to consider when selecting a health insurance plan as a self-employed individual?

Self-employed individuals should consider factors such as coverage options, network providers, premiums, deductibles, copayments, and prescription drug coverage when selecting a health insurance plan.

How have electronic health records benefited self-employed individuals in managing their healthcare?

Electronic health records have streamlined healthcare management for self-employed individuals by providing easy access to medical information, facilitating communication with healthcare providers, and improving coordination of care.

Why is it important for self-employed individuals to prioritize regular health screenings?

Regular health screenings are essential for early detection of potential health issues, allowing self-employed individuals to take proactive steps to maintain their well-being and address any health concerns promptly.